New building permits are up significantly in New York City this year over the same period a year ago, an analysis by YIMBY has found. However, the number of new permits is still far below what it was in 2008, the year before the financial crisis and housing crash.

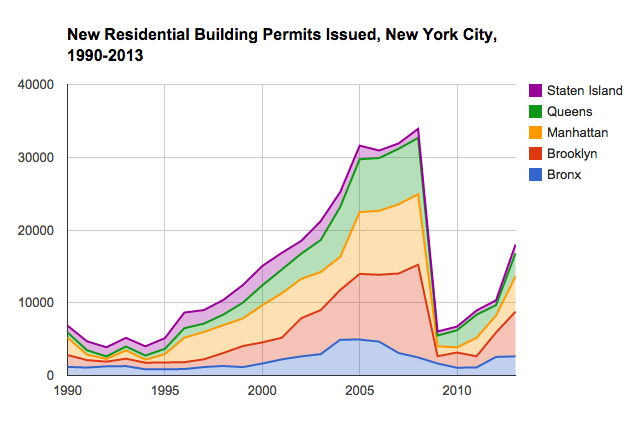

In 2008, New York City issued around 34,000 building permits – more than it had issued in any year going back to at least 1990. New building permits had been steadily climbing since 1992 when only 3,600 were issued, as living in the city became more appealing.

But in 2009 the number of new permits plummeted to just over 6,000, the lowest number since 1995. The city’s housing market has been gradually recovering ever since.

Rapid Growth in New York City

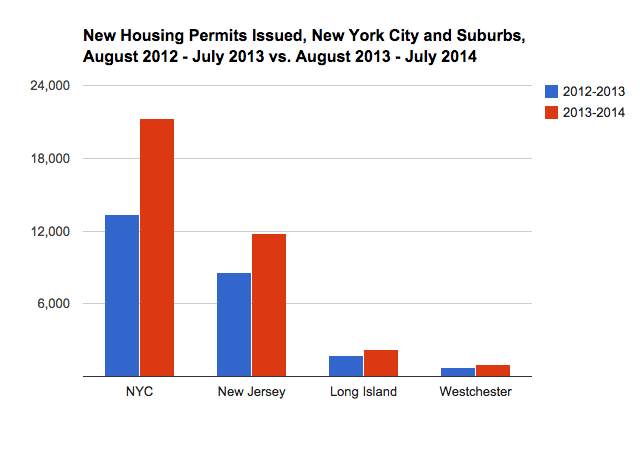

From August 2013 through July 2014, there were 21,244 new building permits issued in New York City, up 59 percent over the previous 12-month period. Housing permit growth was greater in the city than the surrounding suburbs, with the number of permits going up by 24 percent on Long Island, 33 percent in Westchester County, and 38 percent in the close-in New Jersey suburbs (which we’re defining as Hudson, Bergen, Essex and Union counties).

The city’s growth in permits for smaller buildings has been slower than for larger buildings. Permits for buildings with four or fewer families grew 25 percent during the last 12 months, compared with 64 percent growth in buildings with five or more units, part of the dramatic decline in small-scale development that began a few years into Michael Bloomberg’s term, even before the recession.

New Jersey leads suburban growth

Numerically, more permits were issued in New York City over the past year than in the seven surrounding suburban counties combined, which together issued just under 15,000 new permits – around 70 percent of what New York City issued, though their population is about 80 percent of New York’s.

Almost 12,000 new permits were issued in the New Jersey suburbs from August 2013 through July 2014, vastly outpacing Long Island and Westchester County. As a proportion of population, the four densest New Jersey counties issued by far the most permits – they issued permits for four new units for every 1,000 residents they had in 2012, compared with just 2.5 per 1,000 residents in New York City. Westchester and Long Island did much worse, authorizing one new unit and barely more than three-quarters of a unit per 1,000 inhabitants, respectively. The most dire stagnation in housing stock growth is not in New York City or its urban New Jersey suburbs, but in its own in-state suburbs.

New York City still recovering, but New Jersey has rebounded

Though new building in New York is picking up steam, there were still 20,000 fewer permits issued over the last twelve months than during the comparable 2007-2008 period, a 49 percent decline.

Surprisingly, New Jersey exceeded its pre-housing crash peak by 98 permits over the past 12 months. Permits issued in Long Island are down 58 percent from the peak, and down 41 percent in Westchester County.

The New Normal?

In the early 1990s, New York City was still reeling from decades of decay, disinvestment, and population loss. Between 1990 and 1995 the city averaged just 4,900 new permits a year. But as crime was brought under control and city life became more appealing, the pace of new building accelerated, and the number of new permits issued tripled between 1998 and 2005.

As New York City attracts more migrants, both from abroad and from within the country, and the population marches toward nine million, it remains to be seen how much new construction the city can expect in a “normal” year. Many restrictions on new building remain, including the high cost of construction, prohibitive zoning, and some populations deeply hostile to development in their neighborhoods.

The city will add another one million residents by the year 2040 or shortly after, if current projections hold. One estimate suggests that 386,000 additional units will need to be built to house them, or about 14,000 new units a year. The good news is that New York is now on pace to meet that target.

On the other hand, it is difficult to imagine exactly where the 386,000 new units will be built. Many neighborhoods are already built up, and the trend has been to downzone wide swaths of the city’s lower-density areas to preserve neighborhood character. Some have suggested that the city won’t have enough capacity for the expected population growth under current zoning. As new building picks back up, city officials will have to figure out how to sustain the growth in order to keep the city’s housing from becoming even more expensive and crowded.

Talk about this topic on the YIMBY Forums

For any questions, comments, or feedback, email [email protected]

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews