As SL Green is developing Midtown’s largest commercial property at One Vanderbilt across the street from Grand Central Terminal, the company is also building the neighborhood’s smallest ground-up project at 719 Seventh Avenue, just one block north of Times Square’s northern terminus. Despite its diminutive four-story size, the retail building will assert itself via a 150-foot-tall, 5,000-square-foot array of digital billboards. On-site demolition is complete, and excavation is well underway. Pavarini McGovern LLC is listed as the construction manager.

While Times Square proper is saturated with buildings built within the past 50 years, the stretch of Seventh Avenue north of the Square is still dominated by pre-war structures. The site at 719 Seventh was previously occupied by a three-story retail building clad in white stone. Its distinctive feature were the assertive, pyramid-capped columns that framed the windows, with ornate trim running along the cornice line. Unfortunately, the building was disfigured by years of neglect, garish alterations, and omnipresent signage. Although it would have been preservation worthy in many other neighborhoods, it barely made a blip on Times Square’s architectural radar and, given its incredibly lucrative location, really stood no chance within its busy setting.

The new retail building will be barely larger than the structure that it replaces. Permits indicate three floors plus a cellar. The initial development was purported to include at least three nearby properties along Seventh Avenue, which would have given the project eighty feet of exposure along its main frontage. However, the end product sits on a tiny, 2,000 square foot site that measures 25 feet along Seventh Avenue and 80 feet along West 48th Street. The official plans indicate 2,008 square feet per each of the four levels.

The design appears utilitarian, considering that the utility at hand is maximum exposure and curb appeal. Every surface that will not be covered by LED signs will be sheathed in floor to ceiling glass.

Space for construction staging appears absolutely minimal, and even excavation equipment seems to have a tough time negotiating the narrow sliver of pavement between the growing pit and the chaos of Times Square traffic.

It is exceedingly rare to see such small scale of new construction in the center of Midtown, just one block north of the Crossroads of the World. Local properties with large floor plates are at a premium, as evidenced by the demise of the Toys “R” Us a few blocks south. Though the Bow Tie Building that it occupied is another low-rise, at $2,500 per square foot for the ground floor, its 145,000 square feet proved too expensive for the toy store giant.

When horizontal real estate is not available, developers tend to expand skyward. Narrow towers of supertall and near-supertall heights are quickly becoming a staple of the Billionaire’s Row along 57th Street, but the trend is spreading into the Times Square periphery, as well: a 60-story hotel-condo tower is under development on a rather small site six blocks north at 1710 Broadway.

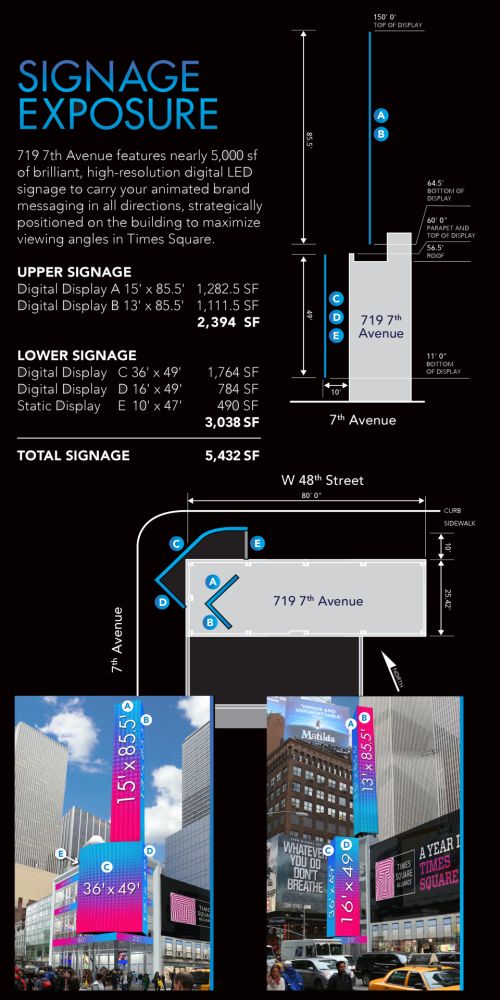

At 719 Seventh, SL Green chose not to sprawl horizontally nor stack floors high into the air. Though the building itself will measure 60 feet to the top of the parapet, a digital pillar will soar 150 feet above the crowded sidewalks.

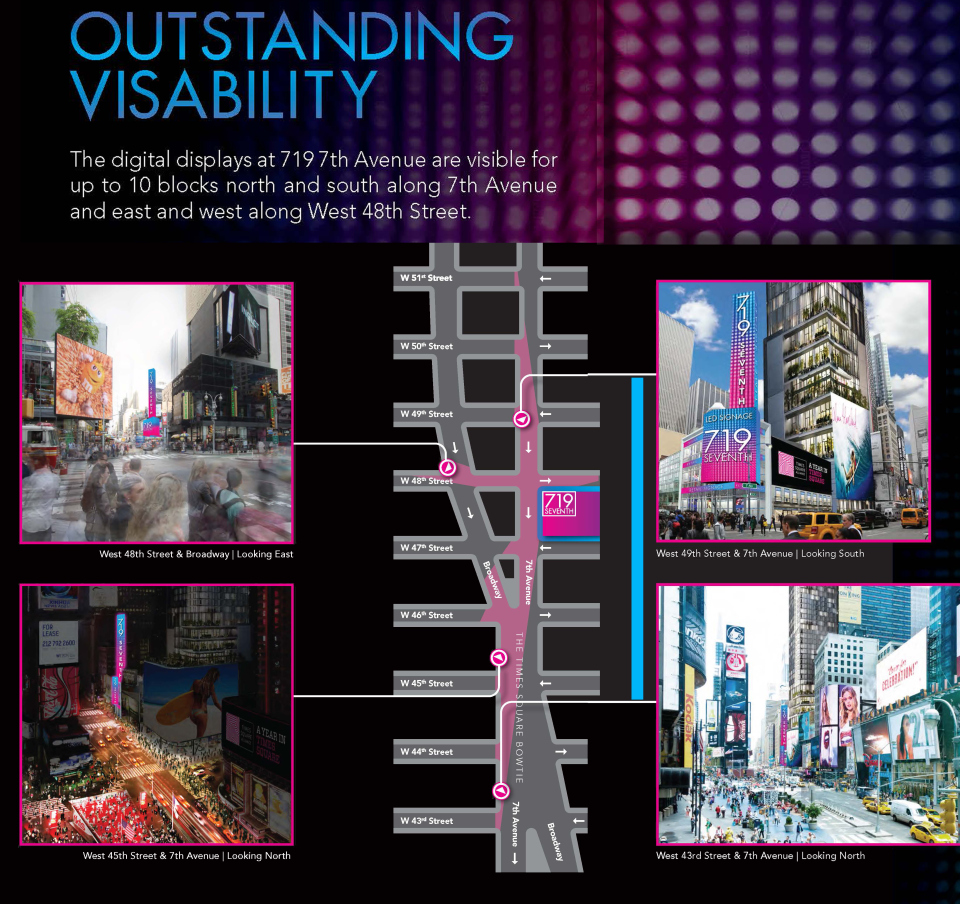

The rectangular banner at the corner along with the pillar will provide a combined 5,000 square feet of LED signage. Its corner location one block north of Times Square proper will allow for visibility from up to 10 blocks north and south along 7th Avenue, as well as east and west along West 48th Street.

The small site fetched one of the highest prices on the market when it was sold for $41.1 million, translating into almost $16,500 per square foot of land, or, given the building’s proposed 8,032 square feet of retail, a staggering $5,117 per square foot of interior space.

Since local retail rent prices have risen as much as 200% within the past fifteen years, SL Green can expect healthy returns from its floor space. However, the income from the displays is equally important, if not more so, than the floor space itself. In 2012, One Times Square on 42nd Street made $23 million from billboard revenue. Though the prices for the visual real estate at 719 Seventh are not publicly disclosed, even if SL Green charges less than One Times Square’s $1 to $4 million per billboard, it can still expect millions of yearly revenue from prospective advertisement clients.

The iconic One Times Square and the small commercial property that is about to rise on the opposite end of the square share more similarities than appear at a first glance. Though 1TS was one of the city’s largest office buildings at the time of construction a century ago in 1904, it ceased being an office building by the end of the 20th century. While its small floorplates would have been unfavorable for many commercial tenants, the deciding factor was the fact that the facade was more profitable as billboard space rather than an illumination device for the interior. Yet as the top 22 floors sit mostly empty, occupied almost exclusively by mechanical equipment, the first three floors are used for retail.

719 Seventh occupies a similarly small footprint and will house four stories of retail. Unlike its famous counterpart, the tall structure above was never meant for tenant habitation, designed directly for digital displays instead.

While the displays will be visible from many points along Times Square, they still have to compete for attention with the rest even on its own block, where the 39-story Marriott Edition Hotel at 20 Times Square is under construction. While its 18,000 square foot LED sign, one of the largest in the city, seems like stiff competition at first glance, it will actually benefit 719 Seventh Avenue as it will draw attention to the block as a whole,.

It is one thing to display a building on a rendering, but it is trickier to properly convey a property that will essentially be a stack of digital displays. If graphic designers substitute ads with generic placeholders, the building might get lost in the visual cacophony of the background. The on-site render shows a corner banner topped by a glowing lightsaber, both proclaiming the building’s address in an assertive manner. Adjacent low-rise properties are plastered in generic ads, and the future Marriott edition hotel is displayed as a small, generic glass box.

The images available on the building’s website use a more engaging approach. Some renderings show the final product complete with ads, while others display screen dimensions. Even the new hotel is presented in an effective manner, with its rendered wall of lush greenery providing a dramatic backdrop for the signage at 719 Seventh.

The associated text promotes the location as ideal for a “flagship store” for prospective tenants that seek visibility within “the world’s busiest shopping area.”

The marketing strategy capitalizes on this adjacency with a virtual, approach, as well. While one promotional map shows the adjacent flagship stores in the vicinity, another displays “Instagram density,” reinforcing the site’s future exposure in social media whether as a focal point or a backdrop for other activities.

The shopping center’s location at the northern end of Times Square puts it within one block of Rockefeller Center. Its visibility from Sixth Avenue along West 48th Street will help draw visitors from that area, as well.

Although there is undeniable potential for revenue at the new building, it is still unusual that it was not developed along with its neighbors as a larger corner property. Though YIMBY supports dense development in areas that can handle the influx of additional users, there are clear upsides to the way things are. Rows of narrow storefronts make for vibrant city blocks that tend to activate urban space more effectively than large, block-busting building bases. 719’s low-rise neighbors, with their pre Giuliani-era retail, remain standing in gritty contrast to the glass towers that are rising on all sides. The vertical climb of incoming signage ensures profitability and visibility for the developer without sacrificing the small scale of the immediate surroundi9ngs. Though we will probably welcome whatever larger development inevitably takes place at the site, it is difficult to be disappointed with the way things turned out.

It is tempting to dismiss Midtown’s smallest ongoing construction project as underwhelming. Despite its thousands of square feet of illuminated billboards, it will compete for attention among a dizzying tapestry of digital displays and an ever-growing neighborhood portfolio of retail. On the other hand, 719 Seventh Avenue follows a proven, decades-old formula while expressing the technological zeitgeist of its time. One way or another, the towering display of dazzling lights, the drive to maximize profit from a small plot of land by any means necessary, and the gesture to command the attention of locals and city visitors alike, all speak to the sense of place at Times Square. Though the construction pit went unnoticed during the New Year’s celebrations, 719 Seventh will be one of the world’s most visible small buildings by the time 2017 celebrations are broadcast around the globe.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

given the project eight feet of exposure along its main frontage. I believe you meant to say 80 feet.

Fixed. Thanks!