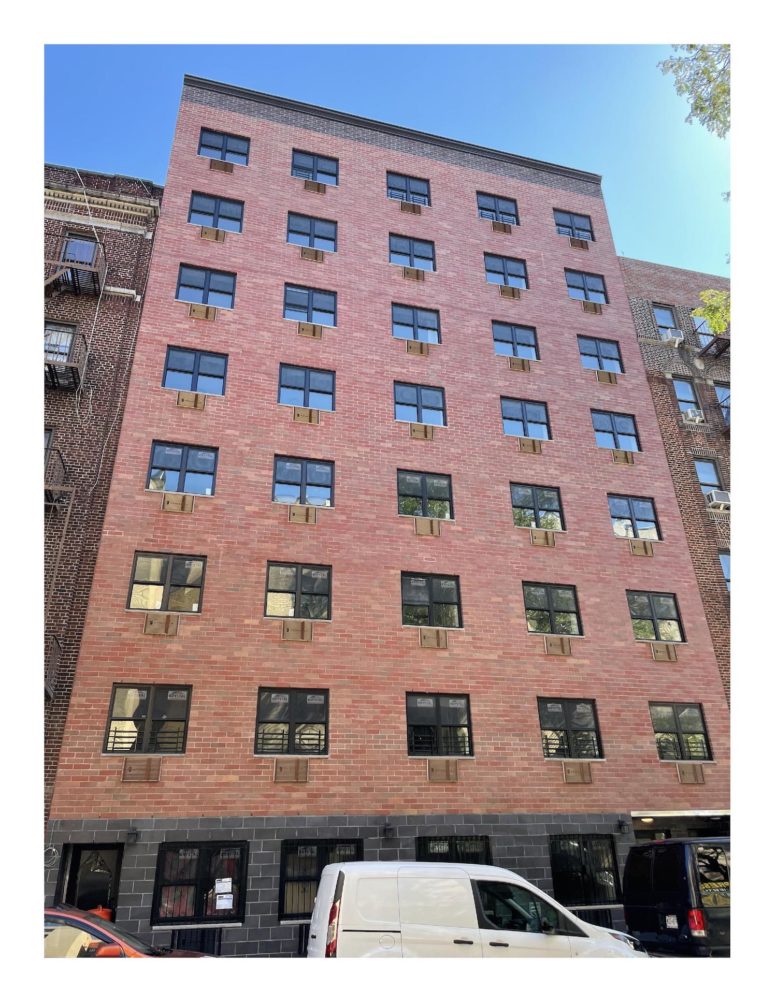

The affordable housing lottery has launched for 2026 Walton Avenue, an eight-story residential building in Tremont, The Bronx. Designed by Fred Geremia Architects & Planners and developed by G & E Walton Developers, the structure yields 43 residences. Available on NYC Housing Connect are 13 units for residents at 130 percent of the area median income (AMI), ranging in eligible income from $44,400 to $167,570.

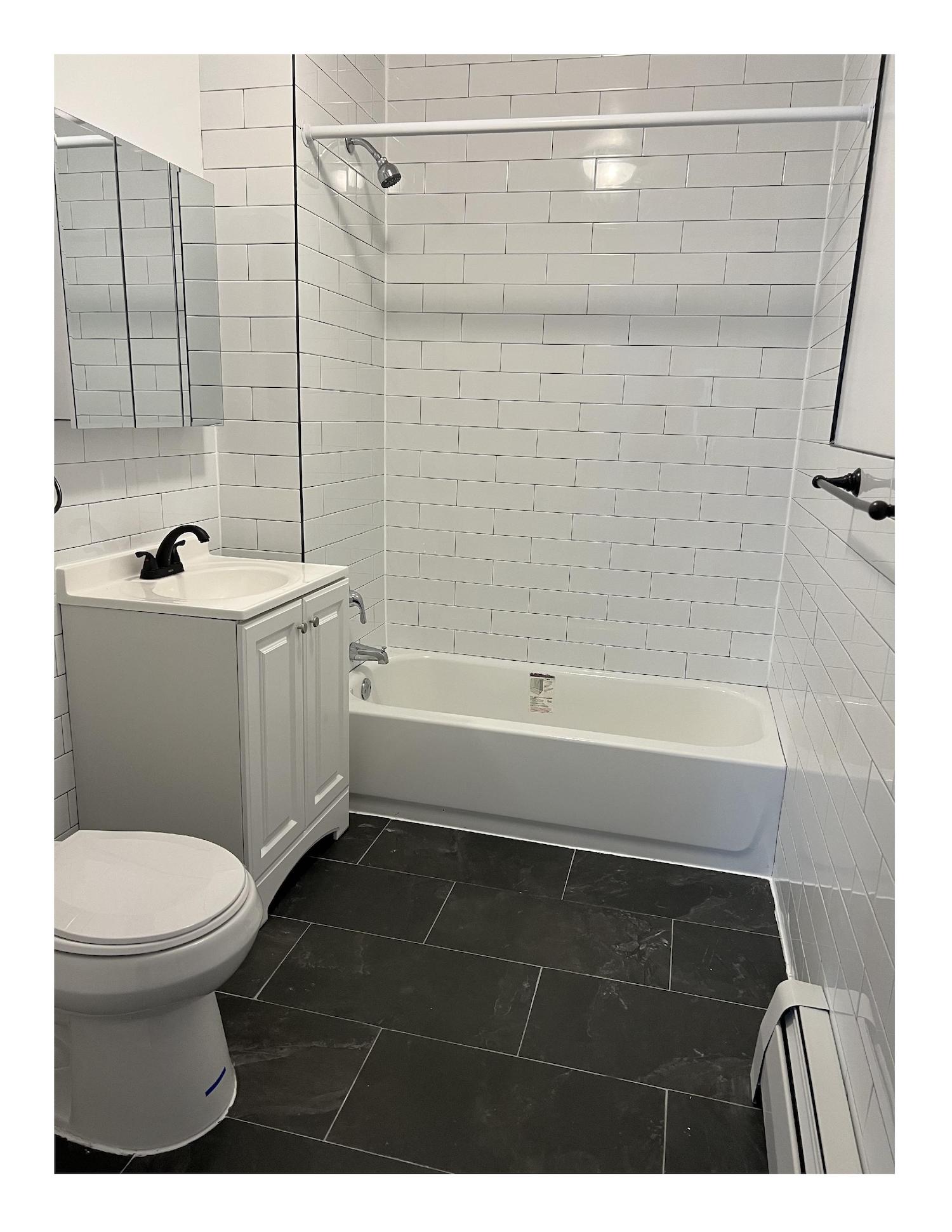

Amenities include a shared laundry room and security cameras. Units come equipped with name-brand appliances and finishes and intercoms. Tenants are responsible for household electricity and landlord is responsible for heat and hot water.

At 130 percent of the AMI, there are four studios with a monthly rent of $1,295 for incomes ranging from $44,400 to $124,150, seven one-bedrooms with a monthly rent of $1,495 for incomes ranging from $51,258 to $139,620; and two two-bedrooms with a monthly rent of $1,795 for incomes ranging from $61,543 to $167,570.

Prospective renters must meet income and household size requirements to apply for these apartments. Applications must be postmarked or submitted online no later than February 14, 2022.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

Gross.

Its what they specialize in. Badaly, Geremia, Bricolage, et al ought to be banned from practicing architecture in this city, if in fact that is what they are even doing. Surely there are hundreds of young eager architects looking for commisions that could deliver more attractive buildings than what these thoughtless jokers come up with. And why are punch through air conditioners still a thing?

And to add insult to injury of this pile of utility bricks, there is a literal carbon copy just three doors down the block.

This ISNT AFFORDABLE HOUSING but INCOME BASED housing

Affordable for who? Not the poor people in this neighborhood

What a joke.

At 130 percent of the AMI, there are four studios with a monthly rent of $1,295 for incomes ranging from $44,400 to $124,150, seven one-bedrooms with a monthly rent of $1,495 for incomes ranging from $51,258 to $139,620; and two two-bedrooms with a monthly rent of $1,795 for incomes ranging from $61,543 to $167,570

If I remember correctly, code (and common sense) requires at least minimum counter space on both sides of a stove. Not true in NYC?

I think it is best practice but not technically code. The wall is certainly going to get greasy.

Thats a facade only an idiocracy could produce. Surely a sign of the decline of western civilization.

please request appointment and application

Crain’s Forum: Affordable Housing

January 27, 2022 01:00 PM updated 23 hours ago

Op-ed: No housing lottery can work when the fundamental issue is a lack of affordable units

Luis Caridad

Tweet

Share

Share

Email

Reprints

Print

Housing

AP

One of the hardest things we do at GOLES (Good Old Lower East Side) is something we do nearly every day: informing someone in dire need of housing that there is little we can do to help.

There are precious few affordable units available in New York City, and most of them are far too expensive. The city’s focus on providing incentives to private developers to build affordable housing keeps coming up short, both in terms of quantity and affordability. It also comes at a significant cost, even beyond taxpayer dollars.

It’s time for the city to pivot to other approaches.

Related Article

Failure to plan: New York is alone among major cities in lacking a comprehensive housing strategy

The city’s most contentious affordable housing program could be getting a makeover

City’s use of income statistics skews ‘affordable’ range

In 2020 the city relaunched Housing Connect, its affordable housing lottery portal, making it easier to navigate and better able to process the enormous number of applications, which crashed the website before. But the fundamental problem—a dearth of affordable housing, especially for very-low-income New Yorkers—remains.

In early January, two-thirds of the open lotteries on Housing Connect required an income of at least $50,000. For the senior citizens who come to our office—who typically earn less than $14,000 per year—there were no open lotteries at all. There usually aren’t.

However these, and similar, apartments were available: a three-bedroom with a rent of $3,580, requiring a family of four to earn $126,686 to $196,845; a studio for $2,490 that requires a single-person income of $85,372 to $108,680.

Relying on incentives for private developers hasn’t worked because building affordable housing is not why they’re in business. As a result, developers often make sure to qualify for incentive programs and build as little affordable housing as required, using the broadest definition of “affordable” allowed. The few resulting units might not be “market rate,” but they’re often not affordable either.

What’s more, even when affordable units are accessible to low-income New Yorkers, they might come at a steep cost to their neighbors. The luxury buildings that contain the units often fuel further luxury development and encourage nearby landlords to increase rents in both legal and illegal ways, pushing long-term residents out in a process known as secondary displacement. In this way, affordable units can become Trojan horses for the vicious cycle of gentrification and displacement.

We know that pattern too well: When several years ago Extell built a luxury megatower in the Two Bridges area of the Lower East Side, a cycle of gentrification and displacement was set in motion.

The developers, who benefited from three city and state incentive programs, built the requisite affordable housing. However, the lowest annual income required to qualify was $34,355, even though the surrounding area’s median income was $21,457.

Recently, Extell described its tower as having “pioneered a new era of luxury on the Lower East Side waterfront.” Local residents wouldn’t disagree. There are four luxury megatowers planned for the neighborhood’s waterfront, right next to the Extell tower—which could spell the end of Two Bridges as a low- and moderate-income multiracial neighborhood.

Or not.

The city, through its zoning, decides what gets built. Community-led rezoning efforts—such as the one GOLES is co-leading in Two Bridges with local tenants, partner organizations and the community board—allow for responsible development while ensuring that local residents have an opportunity to access truly affordable housing.

The city should prioritize community-led rezonings and other strategies, including providing greater support to nonprofit developers and community land trusts. Doing so would help ensure that when a building goes up, new residents are welcomed alongside, not in place of, those who’ve called the neighborhood home for decades.

Luis Caridad is assistant director of GOLES, a neighborhood housing and preservation organization.

Hurray!

More Buildings!

More People!

More Density!

More Traffic on our streets, subways and busses, etc.,

While our fragile infrastructure

continues to crumble.