Once again, January has arrived, alongside New York YIMBY’s annual pipeline report. After our mid-2018 update portended a banner year for new construction, the 2019 report has confirmed it, as the total number of multi-family units filed with the Department of Buildings saw a tremendous surge over the past 365 days. 2018 saw 32,580 multi-family units filed with the DOB, beating 2017’s total of 19,180 units by a whopping 70%. The full 2019 report, containing all 2,482 of 2018’s new building filings in spreadsheet format, is available at the following link for $199.

Including single and two-family buildings, 2018’s total number of new units jumps to 34,039, an increase of 67% over 2017’s figure of 20,393. Besides the massive jump in new building applications, the proportional changes by Borough also shifted substantially from the previous year, which had seen The Bronx and Brooklyn hold strong, while Queens, Staten Island, and especially Manhattan were affected by substantial weakness.

This year, The Bronx saw the lowest percentage increase of any Borough in impending new housing stock, which was still a very appreciable gain, with total submitted units rising 46.5%, from 5,086 to 7,449. Queens had the second-smallest increase, with a 51.3% rise in total new units submitted to the DOB, jumping from 5,154 to 7,798. Brooklyn fell in the middle of the pack, with its 65.4% gain translating into 11,864 units, the largest count of any Borough, and a major increase from 2017’s total of 7,174 new units.

While Brooklyn led the pack in 2017 as well, its total new housing last year would have only put it in 2018’s third position, a testament to the strong growth occurring across the board.

Staten Island saw the second-highest relative gain, with 2017’s total of 514 new units leaping into quadruple digits with a 99.6% increase, reaching 1,026. But Manhattan was the year’s true shining star, witnessing a 139.4% jump in submitted units, which soared from a paltry total of 2,465 in 2017 to 5,902 in 2018.

Delving through the numbers reveals additional interesting details. Of Manhattan’s total new inventory submitted last year, 58% of units resulted from only seven filings of projects with 250 or more dwellings. Of those seven buildings, the top three comprise 2,143 units of new housing, or 36% of Manhattan’s yearly total. Two of those projects, at 601 West 29th Street and 555 West 38th Street, are part of the greater resurgence surrounding Hudson Yards, while 375 West 207th Street is located on the northern tip of the island in Inwood, and also benefits from a rezoning.

Block 675 with 601 West 29th Street (left), 606 West 30th Street (center), and overview image (right)

Outside of Manhattan, the distribution of new development was much more dispersed.

The city’s hotel sector was also healthier in 2018 than 2017. The total number of new rooms filed rose from 4,753 to 5,519, which is on par with most of the recent years of the boom. The tallest and largest of that group is a 531-room project coming to 450 Eleventh Avenue, which will stand 43 floors and 487 feet to its pinnacle.

Besides 450 Eleventh Avenue, which ranks seventh on the list of the top ten tallest buildings filed in 2018, all the other contenders were residential. This is a substantial change from the year before, when only five were multi-family. The change was also echoed in the overall height of the tallest filings, which increased in general, but decreased at the very top of the list.

30-36 East 29th Street, image by CetraRuddy

Sheldon Solow’s planned 12 West 57th Street took the number one spot, at 672 feet to its rooftop. That was followed by 601 West 29th Street and 30 East 29th Street, at 601 and 599 feet each, respectively. Two Manhattan West topped 2017’s list at 895 feet, followed by 29-55 Northern Boulevard and 52-03 Center Boulevard in Queens, at 710′ and 587′. Overall, the number of new filings for buildings of 200′ or higher increased from 29 to 39, while the total for 100’+ structures rose from 89 to 123.

While the addition of substantial new inventory was generally prolific in 2018, the onslaught of new supply does not necessarily portend improvement in the entire market this coming year. Revisiting last year’s pipeline report, YIMBY predicted the below:

2018 seems unlikely to yield any dramatic changes. DeBlasio’s affordable housing push has gained momentum over the past year, and with the City Council now re-organizing around a speaker who isn’t keen on granting members the freedom to deny new housing to their constituents, it would seem that time is on the Mayor’s side. On that front, both Brooklyn, The Bronx, and possibly Queens could continue to see rising new unit counts.

On the market-rate front, things may not be quite so healthy. However, the reduction in pipeline entries since 2014 may finally give room for future entrants by the end of this year. There is a veritable flock of cranes across the Downtown, Hudson Yards, and 57th Street skylines, as the permitting boom of years past finally echoes above and beyond the existing cityscape. Projects like 217 West 57th Street, 111 West 57th Street, One Vanderbilt, and everything over Related’s Eastern Railyards will either top-out or come close by the end of the year, and buildings like 220 Central Park South, 111 Murray Street, and 520 Park Avenue have already reached that milestone.

Given the slacking of the pipeline across this segment in both 2016 and 2017, there appears to be some breathing room finally opening back up for future additions. These may not begin winding their way through the Department of Buildings anytime soon, but by the end of the year, and likely by 2019, the supply shock of so many new supertalls is likely to wane as New York’s population of both ordinary citizens and oligarchs continues to swell.

Breathing room was evidently the dominating theme for 2018, as activity picked up in the beginning of the year and only strengthened vis a vis 2017 until its end. But the oversupply at the top-end of the market is likely not finished its correction, as activity remained somewhat sluggish in this sector, outweighed by the strong performance of rezoning-driven rental buildings, like 601 West 29th Street. New projects like 12 West 57th Street, 30 East 29th Street, 100 Claremont Avenue, 14 India Street, and 1299 Third Avenue are likely to be condominiums aimed at high price-points, but none of these projects are in locations that have traditionally housed properties at the top end of the residential market.

It seems that while the market is still set for saturation in locations like 57th Street, there is now some room for similar inventory of a shorter stature in areas that are peripheral to the current boom, like the edges of NoMad, while some room also evidently remains at the very heart of the 57th Street corridor, even if it isn’t yielding supertalls.

In terms of stock growth, expectations for 2018 were more than met, with anticipated surges in the core Outer Boroughs surpassed by activity in both Manhattan and Staten Island.

What will 2019 bring?

DeBlasio’s push for affordable housing has continued, and activity in 2018 was eager to match. As long as the underlying economy remains relatively strong, there seem to be few reasons that New York’s housing market would fall back towards 2017 levels. Robust numbers from 2018 were concentrated on rental apartments, which is likely to continue into 2019, as the slew of inventory from the supertall filing boom of 2014-2015 is now finally coming onto the market, seemingly all at once. A proliferation of affordable housing in The Bronx and Brooklyn should also continue. In terms of the city’s new construction pipeline, there seem to be few reasons for activity to decrease.

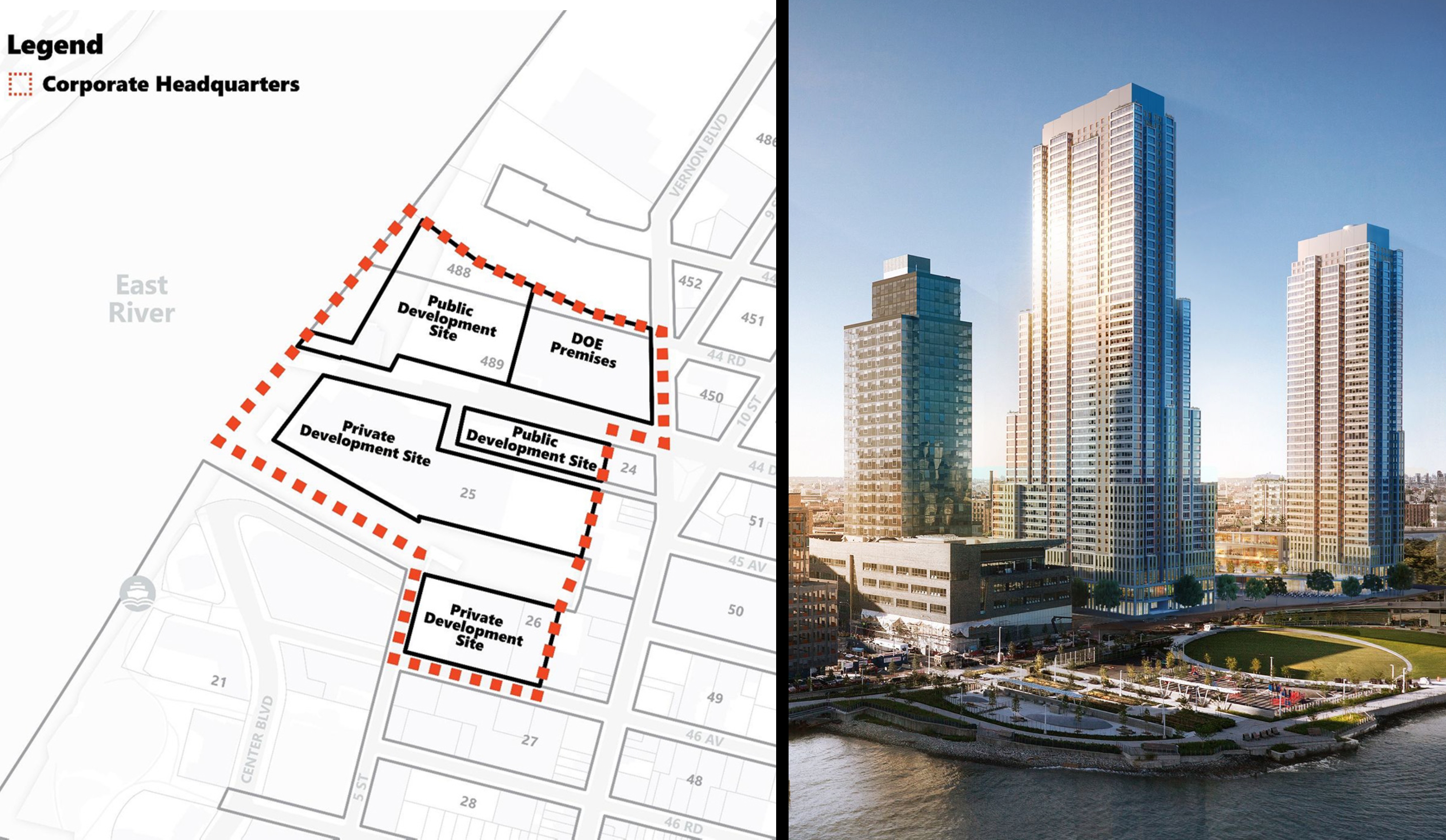

Site map illustrates the location of the new Amazon “HQ2” headquarters in Long Island City / TF Cornerstone’s next Hunters Point South skyscrapers

Thus, YIMBY anticipates relative stability for 2019. While the next year may see another supertall or two filed with the DOB, these are likely to be commercial, with the Midtown East rezoning set to yield at least one imminent behemoth at 270 Park Avenue. Strong activity is also possible in Long Island City, due to Amazon’s recent announcement and commitment for up to 40,000 new jobs, which will likely result in a multitude of new high rises entering the pipeline above and beyond the veritable tsunami of new development already filed with the DOB for the neighborhood.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

Please pardon me for using your space: I make a daily checkup on report with latest charm to all designs, and friendly manner charmed to you. (Thank you so much)

At what point does unchecked growth that caters primarily to the rich turn into a deadly cancer that destroys its host?

Unchecked growth? NYC has some of the most restrictive zoning in the world. It is for this (plus other) reasons that almost all the non-subsidized new housing developments in the city has to cater to the rich. All the added costs to build in this city makes it impossible to build anything but expensive luxury in order to make it worthwhile financially.

Not in our lifetime.

I wish to purchase a hard copy of all construction for the past five years.

I require the address of the property, the borough, the type of construction, the size, and the developer and its mailing address.

Please give me the cost for this information. Thanks Steve 212-580-4085

there will be no sunlight on the streets of manhattan just like the cities of medieval europe only more congested than china.

Darkness at Noon? That’s good title for a dystopian novel.