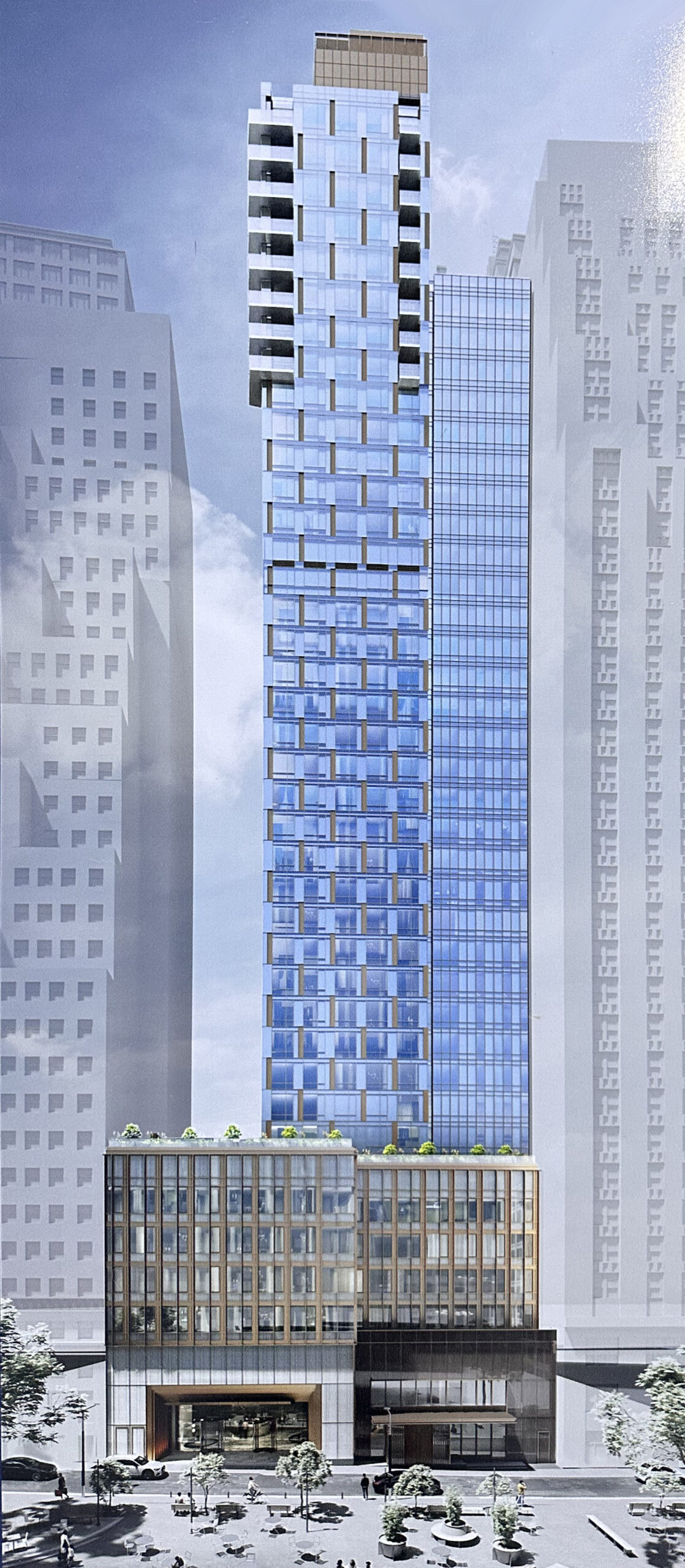

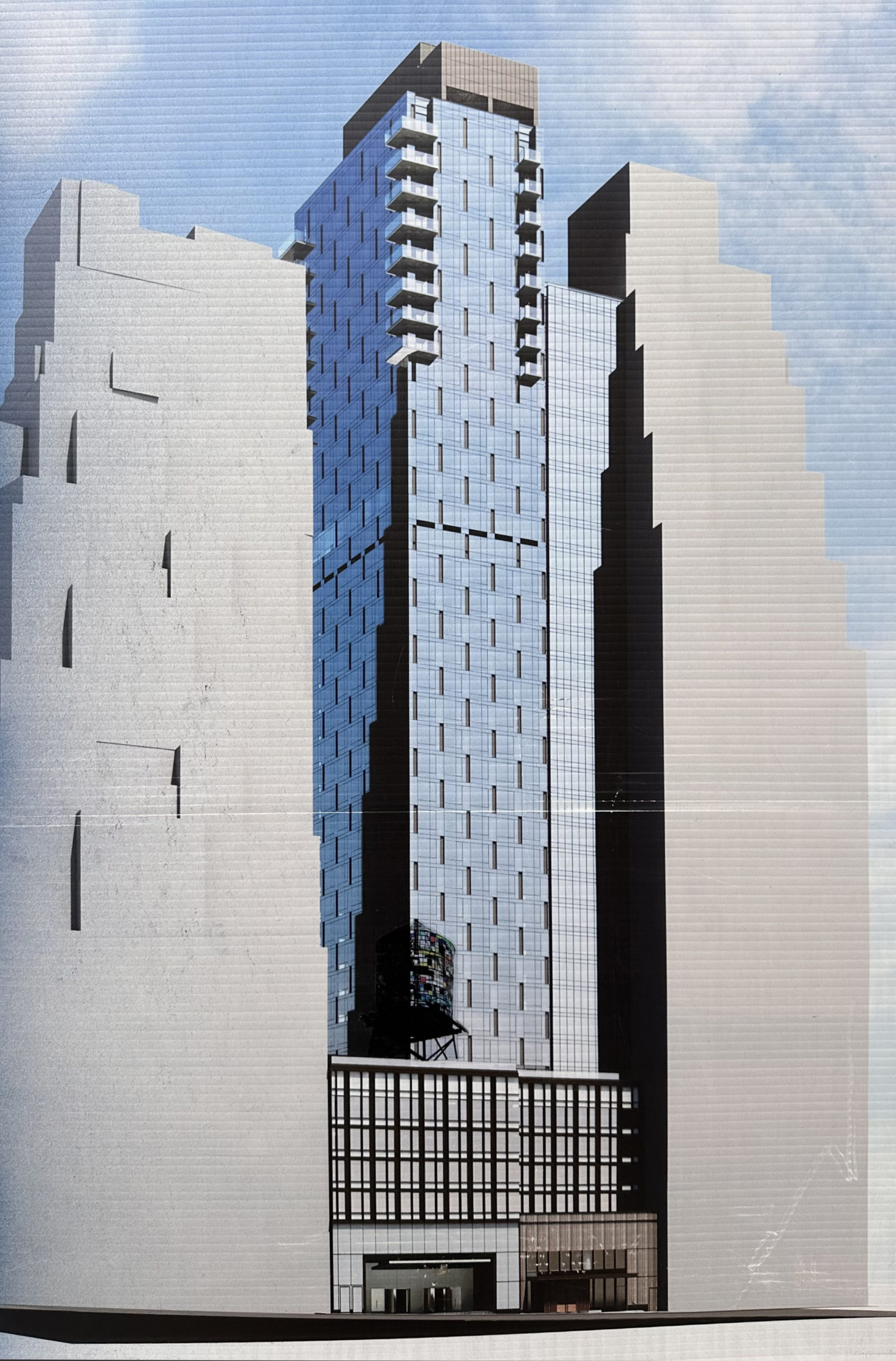

Pearl House Expansion Nears Completion At 160 Water Street in Financial District, Manhattan

Construction is nearing completion on Pearl House, a 29-story office-to-residential conversion at 160 Water Street in the Financial District of Lower Manhattan. Designed by Gensler and developed by Vanbarton Group, the project involves the addition of three floors atop the parapet of the 24-story structure and the conversion of its 525,000 square feet of office space to yield 588 rental units in studio to two-bedroom layouts, as well as a suite of amenities. Compass Development Marketing Group is the exclusive leasing and marketing partner for the property, which is bound by Pearl, Water, and Fletcher Streets.