As YIMBY’s readers must realize by now, 2014 was a banner year for filings in New York City. While supply still clearly falls short of demand, and prices remain at astronomical levels, permit activity at the Department of Buildings shows a massive increase for last year, with the number of units planned to rise nearly doubling. The full data behind this report is available for download at YIMBY research.

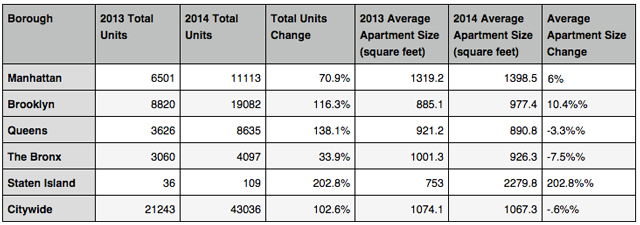

In 2014, permit applications were submitted to construct 44,825 units across the five boroughs, which is a dramatic increase from 2013’s 22,915 housing units. Brooklyn, the city’s most populous borough, led the way, with the number of new units entering the pipeline jumping from 8,473 to 19,355. Queens’ total also more than doubled from 4,316 to 9,367.

Gains were also significant in the other three boroughs, with Manhattan coming out on top. There, 2013’s total of 6,528 rose 70 percent, ending up at 11,113 for 2014. Numbers in the Bronx and Staten Island grew from 3,140 and 458 to 4,253 and 720, respectively.

Hotel activity saw a similarly large increase, with builders filing plans for 8,951 new rooms in 2014. That is a 73 percent increase over 2013’s already-impressive 5,185 new rooms.

Given the type of development that overwhelmingly dominates New York City — multi-family residential, or high-rises for hotels — it should come as no surprise that relatively few projects accounted for a large share of each total. Collectively, the ten largest multi-family projects totaled 7,701 units, or roughly 15 percent of the year’s total. And in terms of hotels, the ten largest equaled 3,819 rooms — or a whopping 43% of the year’s total.

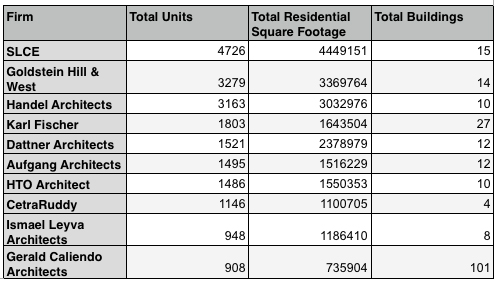

In terms of multi-family, the skew was slightly larger when parsing units by developers, with the top 10 filers in 2014 accounting for 9,484 units, or over 20% of the yearly total. But when the focus changes from developers to architects, the gap becomes yawning.

The 10 architectural firms with the most unit filings last year account for a whopping 20,475 units, or almost half of 2014’s total. SLCE leads, having added 4,726 apartments to the pipeline, or over 10 percent of the city’s new housing stock for 2014, including the 1,028-unit 606 West 57th Street. Goldstein Hill & West and Handel Architects round out the big three, adding 3,279 and 3,163 units, respectively. Important to note is that both SLCE and GH&W architects often acts as the architect of record while another firm actually designs.

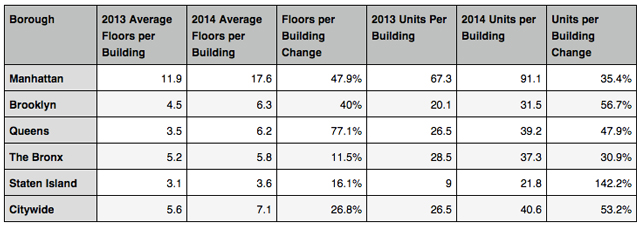

Clearly, a few firms filed for the bulk of New York City’s units last year. But the number of new buildings also increased over 2013, with multi-family filings rising from 795 to 1,053. The average height of new apartment buildings also saw a bump, with the citywide average floors per new application increasing from 5.6 to 7.1.

Average height saw a particularly notable rise in Manhattan, where new buildings grew from an average of 11.9 floors in 2013, to 17.6 floors this past year. Percentage-wise, the greatest increase was actually in Queens, where 2013’s average of 3.5 was bested by last year’s solidly mid-rise average floor count of 6.2.

Projects increased in size and not just height, as well. The average unit count per new multi-family building grew 53 percent from 2013, rising from 26.5 to 40.5. As expected, Manhattan maintained its lead with the largest new developments, with an average of 91.1 units per new multifamily building, up 35 percent from 2013’s 67.3.

It should also be noted that the overall height of 2014’s new filings was staggering. Applications for 51 towers of 300 feet or taller were submitted to the Department of Buildings last year, and 17 of those will eventually rise to over 500 feet. In terms of 500-foot buildings, those figures compare to the entirety of Boston’s current skyline, which only has 16 such structures. Or San Francisco’s, which has eighteen.

Somewhat surprisingly, New York’s imminent supertall boom was not reflected in this year’s filings, as many of the projects in the current wave saw applications filed back in 2013 and 2012. The tallest building on this year’s list is Brookfield’s 401 Ninth Avenue, part of its Manhattan West project, at 995 feet, followed by Vornado’s 220 Central Park South, which should clock in at 950 feet. One caveat is that 30 Hudson Yards is listed at 680 feet because of its “dummy” permit filings, otherwise it would be number one at nearly 1,300 feet.

Waves of permits preceding anticipated changes to the city’s building code may have artificially inflated numbers somewhat. September saw over 20 percent of total filing activity, with applications for 9,390 units submitted, while December’s total of 7,672 was also a significant outlier. Both of these surges came in anticipation of changes to the building code, which was ultimately pushed back from an October 1 cut-off to January 1, 2015.

In sum, the volume of new development increased substantially across New York City in 2014. In terms of changes to the city’s skyline, a San Francisco’s worth of skyscrapers is being pored over by the Department of Buildings. And when it comes to units, 2014’s figure almost doubles 2013’s, signaling a bright future as the city seeks to build more housing — though still more is needed.

Download YIMBY’s 2014 New Construction Report

For any questions, comments, or feedback, email newyorkyimby@gmail.com

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews